|

|

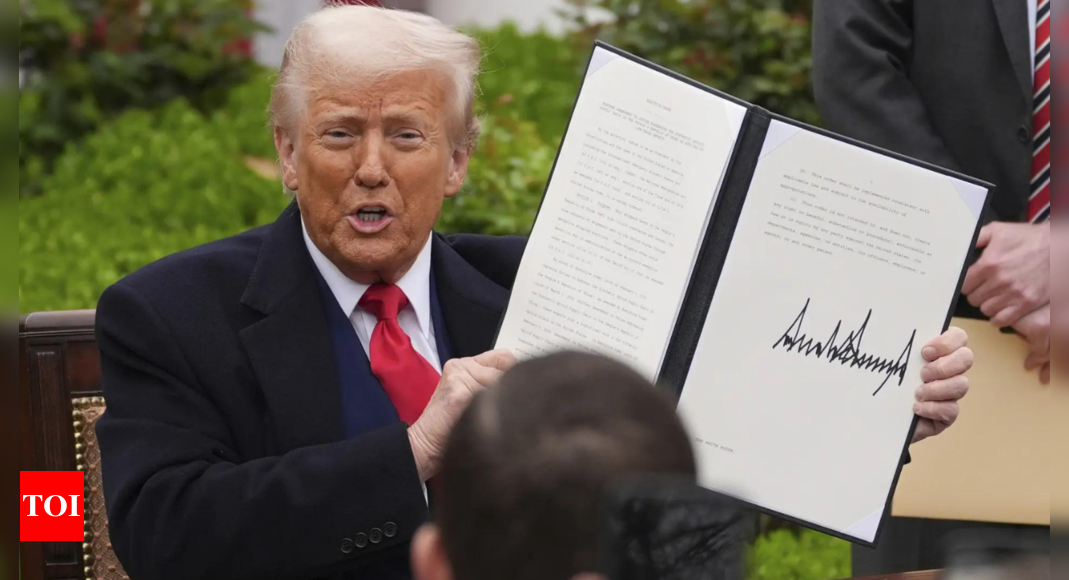

Donald Trump's recent actions concerning trade tariffs have sparked significant turmoil in the US stock market, raising concerns among economists, investors, and even members of his own political base. The article highlights a stark contrast between Trump's optimistic claims of an "economic revolution" fueled by substantial investments and the reality of a massive decline in investor value among America's top companies. This disconnect underscores the inherent risks and uncertainties associated with aggressive trade policies, particularly tariffs, which have historically proven to be a double-edged sword. The immediate impact of Trump's tariff gambit has been a staggering loss of $5 trillion in investor value within a mere two-day period. This financial shockwave has resonated across the nation, impacting millions of retirees who rely on their investments for financial security. The term "Black Monday" has resurfaced on social media, reflecting a growing sense of unease and apprehension about the future of the US economy. The article emphasizes that approximately 60% of American families have investments in the stock market, making them vulnerable to the adverse effects of market volatility. The gravity of the situation is further amplified by the fact that the US stock market has already shed $11 trillion since January 20, adding to the overall sense of economic vulnerability. Despite the mounting evidence of market distress, Trump has remained steadfast in his defense of the tariff policy, asserting that China is bearing the brunt of the trade war. However, this claim is contradicted by numerous economic analyses that suggest the US is also suffering significant economic consequences. China has retaliated against the US tariffs by imposing its own trade restrictions, including a ban on the export of dual-use items to 16 US entities. This tit-for-tat trade war is escalating tensions between the two economic superpowers and creating further uncertainty in the global marketplace. Trump's rhetoric extends beyond China, encompassing a broader critique of other nations that he accuses of treating the US "unsustainably badly." He portrays the US as a "whipping post" that has been exploited by other countries for decades. This narrative resonates with his MAGA base, who believe that the US has been unfairly disadvantaged in international trade agreements. Trump's administration argues that the US trade deficit represents a "transfer of wealth" and that manufacturing jobs have been "stolen" from the US. However, this argument has been met with skepticism and criticism from many economists and financial analysts. Critics argue that tariffs are essentially a tax on American consumers and businesses, as they increase the cost of imported goods. They also point out that the US benefits from access to cheaper goods and services from other countries. Furthermore, some analysts contend that the US has been "ripping off the world" by consuming goods and services produced by other countries in exchange for US dollars. This argument is based on the dollar's status as a reserve currency and the fact that other countries hold large amounts of US debt to keep their currencies stable. The article also highlights the inconsistency in the Trump administration's stance on trade barriers. While Trump officials complain about trade barriers imposed by other countries, including India, the US has also implemented its own trade restrictions, such as those related to genetically modified (GM) crops and phytosanitary requirements. This hypocrisy undermines the credibility of the US's arguments against trade barriers imposed by other countries.

The complexity of international trade and its impact on the global economy demands a nuanced understanding that goes beyond simplistic narratives of winners and losers. Trump's approach to trade, characterized by aggressive tariffs and protectionist measures, has ignited a trade war that threatens to disrupt global supply chains and hinder economic growth. While his supporters may applaud his efforts to protect American industries and jobs, critics argue that his policies are ultimately self-defeating and will harm the US economy in the long run. The article aptly illustrates the divided opinions and expert analysis surrounding Trump's economic policies. Some economists and financial analysts are deeply concerned about the potential for a recession, while others remain cautiously optimistic about the resilience of the US economy. The uncertainty surrounding the trade war is creating a climate of anxiety and volatility in the financial markets. Investors are hesitant to make long-term commitments, fearing that escalating trade tensions will further erode investor confidence. The article also raises important questions about the role of the US in the global economy. Is the US justified in imposing tariffs on other countries simply because it believes it has been treated unfairly? Or does the US have a responsibility to uphold the principles of free trade and international cooperation? These questions are at the heart of the debate over Trump's trade policies. The administration's narrative of economic revolution resonates with a segment of the population that feels left behind by globalization and technological change. Trump's promises to bring back manufacturing jobs and restore American economic dominance appeal to voters who are nostalgic for a bygone era. However, critics argue that Trump's policies are based on a flawed understanding of economics and that they will ultimately fail to achieve their intended goals. The article suggests that Trump's trade policies are driven by a combination of economic nationalism and political opportunism. By blaming other countries for the US's economic woes, Trump is able to rally his base and deflect criticism of his own policies. However, this strategy carries significant risks. The trade war could escalate out of control, leading to a global recession. Furthermore, Trump's isolationist policies could damage the US's relationships with its allies and undermine its leadership role in the world. The article emphasizes the need for a more thoughtful and pragmatic approach to trade policy. The US should engage in constructive dialogue with its trading partners to address legitimate concerns about trade imbalances and unfair trade practices. However, it should also avoid resorting to protectionist measures that will ultimately harm the US economy and the global economy. The article also highlights the importance of education and job training. To compete in the global economy, the US needs to invest in its workforce and equip workers with the skills they need to succeed in high-paying jobs. This will require a concerted effort from government, businesses, and educational institutions. Finally, the article underscores the importance of international cooperation. The challenges facing the global economy are too complex for any one country to solve on its own. The US needs to work with its allies to address issues such as climate change, poverty, and inequality.

The long-term consequences of Trump's trade policies remain uncertain, but the immediate impact has been undeniably negative. The market volatility, the loss of investor value, and the escalating trade tensions are all signs that the trade war is taking a toll on the US economy. The article serves as a timely reminder of the interconnectedness of the global economy and the importance of responsible trade policies. Trump's approach to trade has been characterized by a willingness to disrupt existing trade agreements and challenge the status quo. While some may see this as a necessary step to protect American interests, others view it as a reckless gamble that could backfire and damage the US economy. The article provides a balanced perspective on the trade war, presenting both the arguments in favor of and against Trump's policies. It highlights the complexities of international trade and the need for a nuanced understanding of the issues at stake. The article also underscores the importance of economic literacy. Many Americans lack a basic understanding of economics, which makes them vulnerable to misinformation and propaganda. The article helps to educate readers about the key concepts and issues involved in the trade war. The article concludes by urging policymakers to adopt a more thoughtful and pragmatic approach to trade policy. The US should engage in constructive dialogue with its trading partners and avoid resorting to protectionist measures that will harm the US economy. The article also emphasizes the importance of investing in education and job training to prepare American workers for the challenges of the global economy. The article successfully encapsulates the essence of the ongoing debate surrounding Trump's trade policies, presenting a multifaceted analysis of the economic and political implications. It avoids taking a definitive stance, instead offering a comprehensive overview of the various perspectives and arguments involved. This balanced approach allows readers to form their own informed opinions about the trade war and its potential consequences. The article's strengths lie in its ability to synthesize complex economic concepts into accessible language, making it understandable to a broad audience. It also effectively incorporates quotes from experts and analysts, providing a diverse range of viewpoints. The article's weaknesses, if any, lie in its length and depth of analysis. While it provides a solid overview of the trade war, it could benefit from delving deeper into specific aspects of the issue, such as the impact on particular industries or the potential for long-term economic damage. Overall, the article is a valuable resource for anyone seeking to understand the complexities of the trade war and its implications for the US economy.

Source: Trump tees off with tariff bogey amid meltdown in US markets