|

|

The escalating trade tensions, primarily fueled by U.S. President Donald Trump's tariff policies, have cast a long shadow over the global economic landscape. The Reserve Bank of India (RBI), acknowledging the potential repercussions, has taken a measured step by revising its growth forecast for the fiscal year 2025 downwards by 20 basis points, a move that underscores the pervasive uncertainties gripping the world economy. This decision, as articulated by RBI Governor Sanjay Malhotra, is not merely a knee-jerk reaction but a carefully considered response to the evolving dynamics of international trade and the inherent risks associated with protectionist measures. The reduction in the growth projection from 6.7% to 6.5% reflects a pragmatic assessment of the challenges posed by the global trade war and its potential impact on India's economic trajectory. The RBI's monetary policy committee (MPC), in its deliberation, meticulously weighed the various factors at play, including the potential disruptions to global supply chains, the dampening effect on investment sentiment, and the overall slowdown in international trade volumes. The downward revision is a testament to the interconnectedness of the global economy and the vulnerability of even relatively insulated economies like India to external shocks. The tariff war, in essence, represents a significant departure from the principles of free trade and multilateralism that have underpinned global economic growth for decades. The imposition of tariffs and other trade barriers disrupts established trade relationships, increases costs for businesses, and creates uncertainty for investors. The RBI's decision to cut the growth forecast is a clear signal that these uncertainties are not to be taken lightly and that a proactive approach is necessary to mitigate the potential negative consequences. The impact of the tariff war is not uniform across countries. Some economies are more exposed than others, depending on their reliance on exports, their level of integration into global supply chains, and their trade relationship with the U.S. India, according to the RBI's assessment, is relatively better positioned compared to many other countries to weather the storm. This is primarily due to India's lower export-to-GDP ratio and its relatively smaller trade surplus with the U.S. However, this does not mean that India is immune to the effects of the tariff war. The reduction in the growth forecast is a clear indication that even a less exposed economy like India will feel the pinch of global trade tensions. The RBI's assessment also highlights the potential impact of the tariff war on inflation. While the reduction in demand resulting from the trade friction could potentially dampen inflationary pressures, the overall impact on inflation is uncertain. The RBI's primary concern, however, is the impact of the tariff war on growth. The central bank is closely monitoring the situation and is prepared to take further action if necessary to support economic growth and maintain price stability. The RBI's response to the tariff war is part of a broader effort to promote economic resilience and stability in the face of global challenges. The central bank has been actively working to strengthen the financial sector, improve the payment system, and promote financial inclusion. The RBI's proactive approach to managing the challenges posed by the global trade war is a testament to its commitment to ensuring the long-term stability and prosperity of the Indian economy. The global trade landscape is constantly evolving, and the RBI must remain vigilant and adaptable to navigate the challenges and opportunities that lie ahead.

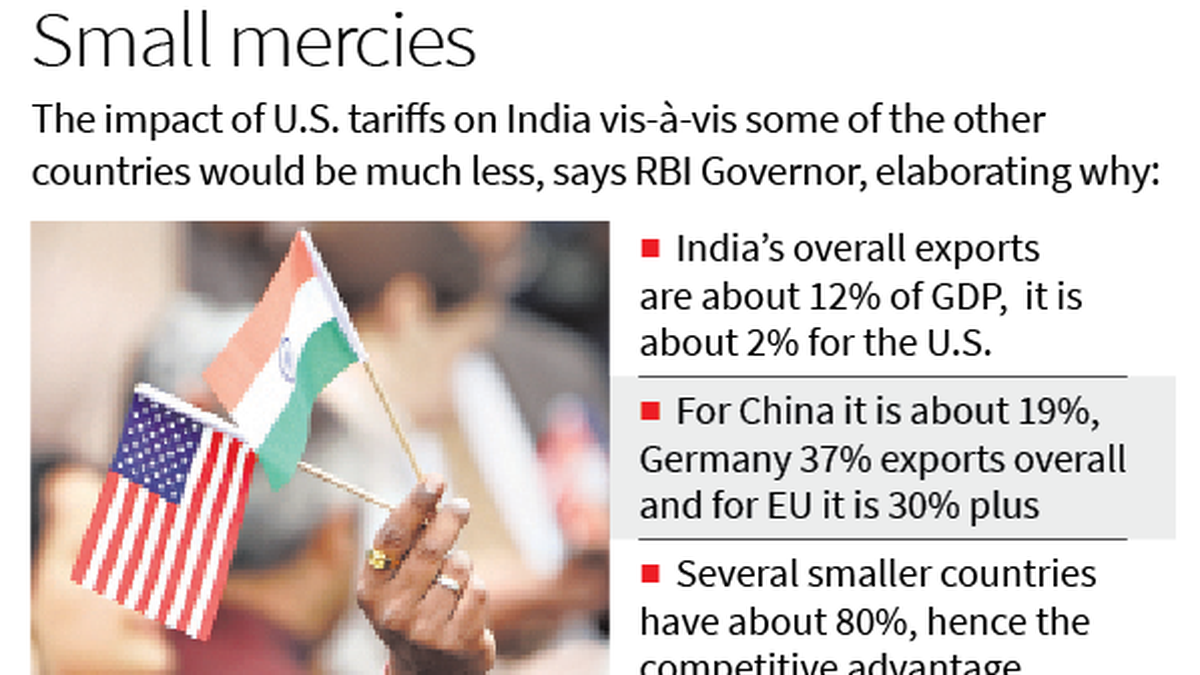

India's relatively lower export-to-GDP ratio compared to other major economies provides a degree of insulation from the direct impacts of the U.S.-China trade dispute. Governor Malhotra emphasized that India's overall exports constitute approximately 12% of its GDP, a figure significantly lower than those of countries like China (19%), Germany (37%), and even the European Union (30%+). Some smaller economies are even more dependent on exports, with export-to-GDP ratios exceeding 80%. This disparity places India in a more advantageous position, particularly concerning trade relations with the United States. The implication is that fluctuations in U.S. demand or changes in U.S. trade policy are less likely to have a profound impact on India's overall economic performance compared to countries with higher export dependencies. However, it's crucial to recognize that this comparative advantage doesn't render India impervious to the global trade slowdown. While the direct impact on exports might be mitigated, indirect effects stemming from weakened global demand, disruptions in supply chains, and increased uncertainty in investment climates can still exert considerable pressure on the Indian economy. Moreover, the composition of India's exports matters. If a significant portion of India's exports are intermediate goods used in the production of goods ultimately destined for the U.S. market, the impact of U.S. tariffs could be amplified. Therefore, a nuanced understanding of India's export structure is essential for accurately assessing the potential risks and formulating appropriate policy responses. The RBI's assessment underscores the importance of diversification in India's export markets. Reducing reliance on specific countries or regions can enhance resilience to external shocks. Actively pursuing new trade agreements and fostering stronger economic ties with diverse partners can help mitigate the risks associated with protectionist measures implemented by any single nation. Furthermore, promoting competitiveness in key export sectors is crucial. Investing in infrastructure, improving productivity, and reducing regulatory burdens can enable Indian exporters to better compete in the global marketplace and withstand the challenges posed by trade wars. The Indian government and the RBI are likely to adopt a multi-pronged approach to navigate the complexities of the evolving global trade landscape. This approach would involve closely monitoring global developments, engaging in diplomatic efforts to promote free and fair trade, implementing policies to enhance competitiveness, and providing support to affected industries. The challenge lies in striking a balance between protecting domestic interests and fostering international cooperation. A purely protectionist stance could harm India's long-term growth prospects, while a completely open approach could leave the economy vulnerable to external shocks. A carefully calibrated strategy that combines prudent risk management with a commitment to global engagement is the most likely path forward.

The potential devaluation of the Chinese Yuan and its implications for the Indian Rupee represent another significant challenge for the RBI. Governor Malhotra acknowledged the possibility of China devaluing its currency in response to the trade war, but he expressed confidence in the Rupee's stability and the RBI's ability to manage any excessive volatility. The statement that the Rupee would "find its own level" suggests a commitment to allowing market forces to play a dominant role in determining the currency's value. However, the assurance that the RBI would intervene in case of "excessive volatility" indicates a willingness to step in and prevent disruptive fluctuations that could destabilize the Indian economy. The RBI's substantial foreign exchange reserves, nearing $700 billion, provide a significant buffer against external shocks and allow the central bank to intervene effectively in the currency market. These reserves can be used to buy Rupees and support its value if it comes under pressure. Furthermore, India's relatively sustainable current account deficits for the current and subsequent fiscal years suggest that the economy is not overly reliant on foreign capital inflows, reducing its vulnerability to currency depreciation pressures. However, the devaluation of the Yuan could still have significant implications for the Indian Rupee. A weaker Yuan would make Chinese goods cheaper in international markets, potentially putting downward pressure on the Rupee as Indian exporters face increased competition. This could also lead to a widening of India's trade deficit. Moreover, a Yuan devaluation could trigger a wave of competitive devaluations by other countries in the region, further exacerbating the pressure on the Rupee. The RBI must carefully monitor these developments and be prepared to take appropriate action to manage the Rupee's value and maintain financial stability. The central bank's response could involve a combination of measures, including currency intervention, interest rate adjustments, and macroprudential policies. The choice of policy instruments would depend on the specific circumstances and the nature of the pressures facing the Rupee. It is important to note that currency intervention is not a panacea. While it can be effective in smoothing out short-term volatility, it is unlikely to be successful in preventing a sustained depreciation of the Rupee if the underlying economic fundamentals do not support its value. Therefore, the RBI must also focus on addressing the root causes of any potential Rupee weakness, such as a widening trade deficit or a decline in investor confidence. The RBI's management of the Rupee in the face of potential Yuan devaluation will be a crucial test of its policy credibility and its ability to navigate the complexities of the global financial system. A well-calibrated and transparent approach that balances market forces with prudent intervention is essential for maintaining stability and fostering confidence in the Indian economy.

Source: India better off than others in tariff row: RBI Governor