|

|

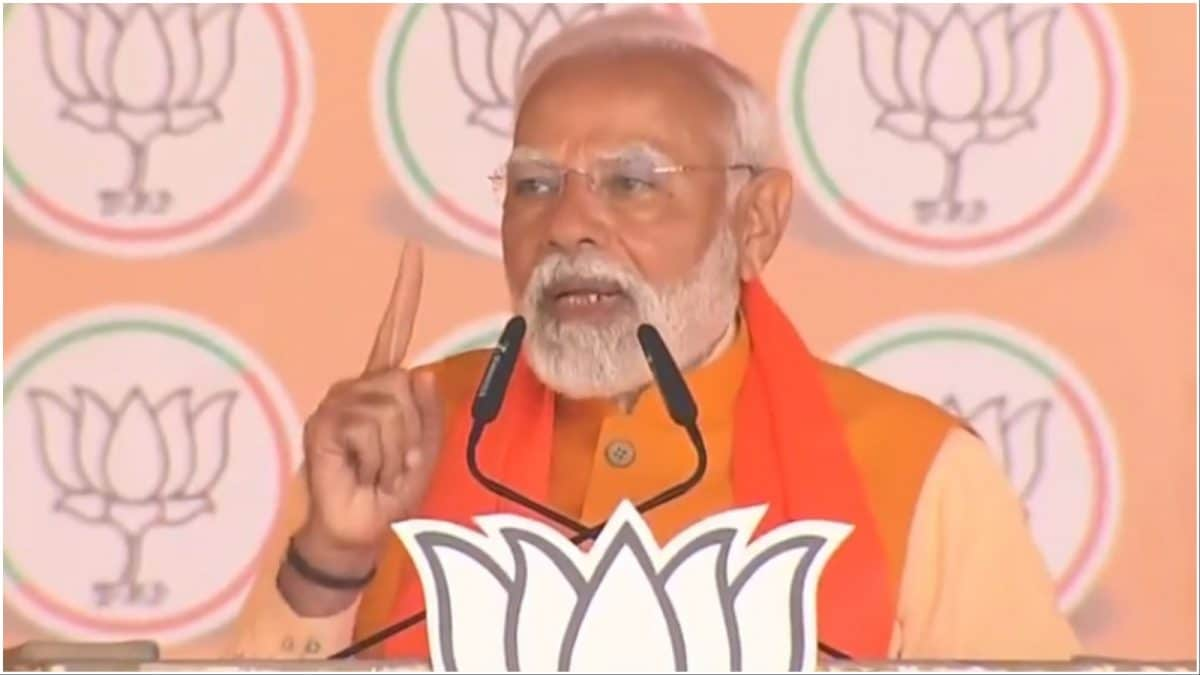

The recent Union Budget 2025 presented by Finance Minister Nirmala Sitharaman has sparked significant political debate in India, particularly concerning its impact on the middle class. Prime Minister Narendra Modi, in a rally following the budget's announcement, lauded the changes as the most 'middle-class friendly' in the nation's history. His address focused heavily on comparing the current tax regime to those implemented during the Congress party's leadership, particularly under Jawaharlal Nehru and Indira Gandhi. Modi's rhetoric effectively frames the BJP's economic policy as a stark contrast to its predecessor, highlighting a significant shift in the approach to taxation and economic development. This strategic communication aims not only to garner support for the BJP but also to portray the Congress party's economic policies as outdated and detrimental to the aspirations of average Indians.

Modi's central argument revolves around the significant tax relief offered to individuals earning up to Rs 12 lakh annually. He dramatically illustrated the purported disparities by contrasting the tax burdens faced by individuals with that income during different periods. According to Modi, during Nehru's era, a 25% tax was levied on Rs 12 lakh income, implying a substantial deduction from earnings. Under Indira Gandhi's leadership, he asserted, Rs 10 lakh out of Rs 12 lakh was taxed, signifying an even more aggressive taxation policy. He further stated that until 10-12 years ago, under the Congress government, a Rs 12 lakh annual income would have resulted in a tax liability of Rs 2.6 lakh. This stark comparison is designed to emphasize the present government's commitment to easing the financial burden on the middle class, a key demographic group in India’s electorate.

The budget's provisions, including the raised exemption threshold from Rs 7 lakh to Rs 12 lakh and the additional Rs 75,000 standard deduction, are central to Modi's narrative. These measures effectively eliminate the tax burden for a significant portion of the population and significantly reduce the tax liability for many others. The finance minister herself emphasized the broad impact of these reforms, stating that over 1 crore individuals would no longer be required to pay taxes under the new system. This, coupled with the substantial tax savings for those earning up to Rs 25 lakh, paints a picture of significant financial relief for a substantial segment of the Indian population. The government's claim that over 80 percent of taxpayers would benefit reinforces the image of a budget tailored to alleviate the financial pressure on ordinary citizens.

However, Modi's assertions require closer scrutiny. The historical comparisons presented, while attention-grabbing, lack specific contextual details. The tax rates during Nehru's and Indira Gandhi's times were influenced by various socio-economic factors, including the nation's developmental stage, international relations, and the overall fiscal landscape. Without factoring in inflation, changes in tax brackets, and other relevant economic indicators, the comparison may be misleading and oversimplify the complexities of past tax policies. Furthermore, the claim that this is the 'friendliest' budget for the middle class warrants examination in the context of the government’s wider economic policies and their impact on the various segments of Indian society.

The presentation of the budget as a direct result of the BJP's commitment to the middle class, and a clear contrast to the Congress's alleged neglect, is a key element of the political messaging. This narrative is likely to be strategically deployed in the upcoming elections, framing the BJP as the party that genuinely champions the interests of the average Indian citizen. By associating the budget's positive impact directly with the BJP's governance, Modi seeks to reinforce the party's image as the protector of the middle class and consolidate its electoral base. The success of this strategy will depend, however, on how effectively the government communicates the nuances of the budget's reforms and addresses any potential criticisms regarding its overall economic impact.

Source: 'If You Earned Rs 12 Lakh In Nehru's Era...': PM Modi's Dig At Congress After Budget Tax Cut