|

|

This week's market activity will be significantly influenced by a confluence of macroeconomic data releases and corporate earnings announcements, as highlighted by analysts. The primary focus will be on inflation numbers, both domestically and internationally, coupled with a close observation of global market trends and the trading activity of Foreign Institutional Investors (FIIs). The US inflation data for January, due on Wednesday, will be particularly crucial, providing insights into the Federal Reserve's potential interest rate adjustments. Simultaneously, the testimony of Fed Chair Jerome Powell will be meticulously analyzed for any indications of future monetary policy shifts. This data holds significant weight, as it directly impacts investor sentiment and investment strategies globally. The release of this data is expected to influence global markets and, consequently, the Indian market.

Concurrently, India will release its own vital economic indicators. The inflation and industrial production data, scheduled for February 12th, will provide a domestic perspective on economic health. These figures, coupled with the ongoing quarterly earnings announcements from major companies, add another layer of complexity to market analysis. The performance of companies like Eicher Motors, Grasim Industries, Vodafone Idea, and Steel Authority of India will undoubtedly influence investor decisions. A strong earnings season could bolster market confidence, while disappointing results may lead to a sell-off. The interplay between domestic and international economic indicators will be a determining factor in overall market direction this week. This week will test the resilience of investor sentiment given the interlinked nature of global and domestic economic performances.

Adding another dimension to market analysis is the recent political development in Delhi. The BJP's decisive victory in the Delhi elections has introduced a political element into the market equation. While analysts predict a short-term positive impact due to the ruling party's continued dominance, the long-term implications remain uncertain. The medium to long-term market trend will heavily depend on the recovery of GDP growth and a subsequent rebound in corporate earnings. This underscores the intricate relationship between political stability and economic performance. The market’s reaction to the election results will be observed as an indicator of investor confidence in the government’s economic policies and their effectiveness in stimulating growth.

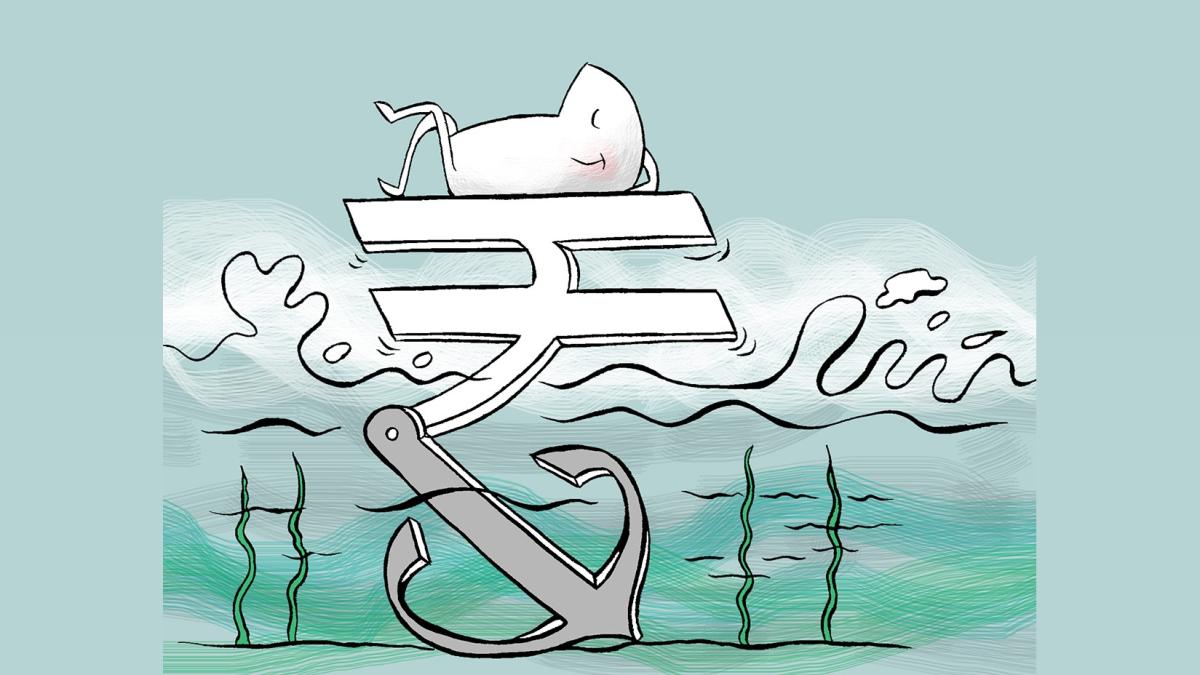

The rupee-dollar exchange rate will also play a crucial role in determining market direction. Fluctuations in the currency pair can significantly impact investor returns, especially for those involved in international trade. Furthermore, the overall global market sentiment, particularly concerning the performance of major economies like the US and the UK, will inevitably influence the Indian market's performance. Data such as the UK's GDP growth, scheduled for Thursday, and the US retail sales figures for January, to be released on Friday, will offer further clues about the global economic climate. These global indicators will be analyzed in conjunction with the domestic economic data, creating a complex interplay of factors that will ultimately shape the trajectory of the Indian markets this week.

In summary, the Indian markets face a week of intense scrutiny, as investors carefully dissect a range of economic data, corporate earnings reports, and political developments. The interplay between domestic and global factors creates an environment of both opportunity and uncertainty. Analyzing the collective impact of inflation figures, industrial production data, FII activity, and global economic indicators will be paramount in predicting the markets' movements. It is crucial for investors to remain informed and adapt their strategies in light of this dynamic and multifaceted landscape. Furthermore, the ongoing geopolitical situation and any unforeseen events could also introduce additional volatility into the markets. Therefore, a balanced approach that considers various factors and is cognizant of potential risks is necessary for effective market navigation this week.

Source: Markets to Track Inflation, Global Trends, FII Activity