|

|

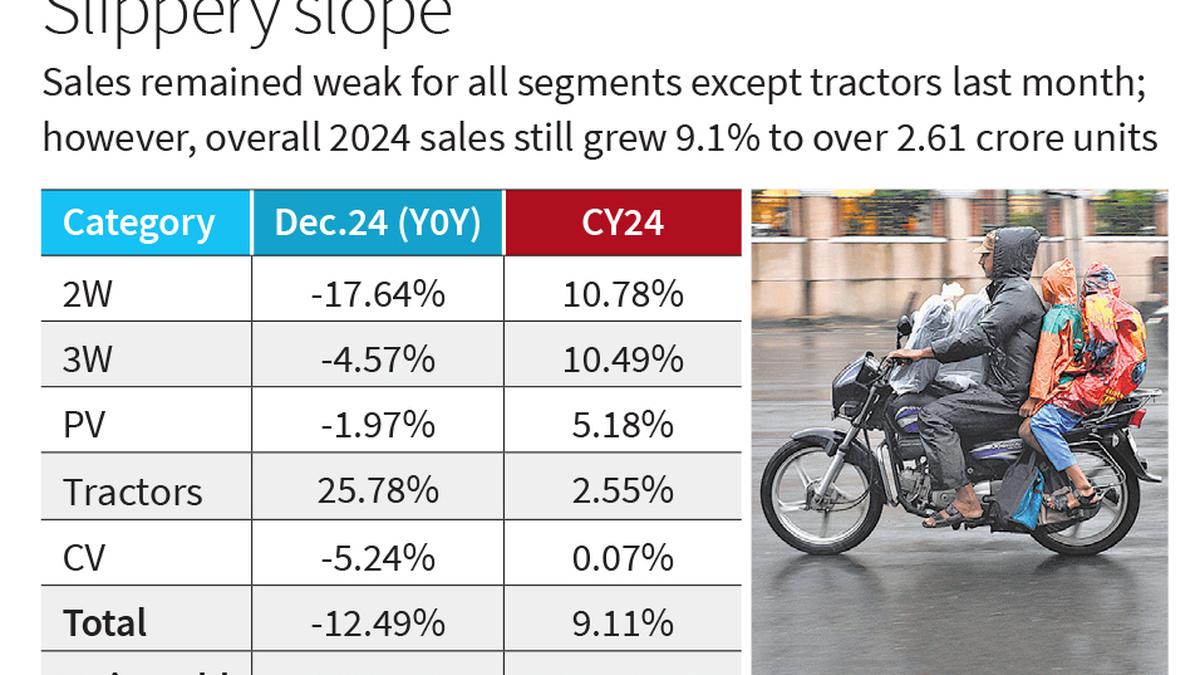

The Federation of Automobile Dealers Associations (FADA) reported a significant downturn in India's automobile retail sales during December 2024. The overall decline reached 12% year-on-year (y-o-y) and a staggering 45.26% month-on-month (m-o-m), painting a bleak picture of the current economic climate and consumer demand. This sharp contraction underscores a broader trend of slowing economic activity within the Indian market, impacting various sectors beyond just automobiles. The report provides granular details across different vehicle categories, revealing a complex interplay of factors driving this downturn. The substantial drop across most vehicle categories highlights the widespread impact of this economic slowdown. The exceptions, like the positive growth in tractor sales, indicate sector-specific variations in resilience and demand.

A deeper analysis of the FADA report reveals the individual struggles of different vehicle categories. Two-wheelers (2W) experienced the most dramatic fall, plummeting by 17.6% y-o-y and 54.2% m-o-m. FADA attributes this significant drop to several factors. Delayed crop payments and halted government disbursements negatively affected rural purchasing power, a key driver of 2W sales. The usual year-end slowdown in purchasing, often seen in the December period, further exacerbated the decline. Supply-chain challenges involving popular models and the increasing market shift towards electric vehicles (EVs) also contributed to reduced sales volumes. This complex interplay of macroeconomic conditions and industry-specific trends underlines the multifaceted nature of the current crisis facing the automotive sector.

The passenger vehicle (PV) segment, while less dramatically affected than 2Ws, still showed a decline of 1.9% y-o-y and 8.8% m-o-m. According to C. S. Vigneshwar, FADA president, high inventory levels following the festive season played a considerable role. Aggressive discounting strategies implemented by manufacturers to clear excess stock further depressed margins and contributed to the sales dip. Mr. Vigneshwar also highlighted a confluence of additional factors contributing to the decline, namely a poor overall market sentiment, a lack of new model launches, and intense price competition between dealerships. He noted that inventory levels have now normalized, falling to 55-60 days, indicating some progress in managing stock imbalances. However, the lingering impact of these factors suggests that the PV market may remain subdued in the near future.

The commercial vehicle (CV) sector also experienced a contraction, albeit less severe than the 2W and PV segments. A 5.2% y-o-y and 12.1% m-o-m decrease reflects the overall economic slowdown. Low market sentiment, delayed government funding releases, and difficulties in securing financing approvals directly contributed to this decline. Many potential buyers postponed purchases, citing a preference for the newer 2025 models as a primary reason for the delay. This points towards a cautious consumer outlook and a wait-and-see approach amongst business owners reliant on CVs for their operations. The overall market sentiment remains cautious, but hints of optimism are present.

Despite the negative trends in December, the full calendar year 2024 (CY2024) showed a positive overall growth in auto retail sales of 9% compared to the previous year. This positive annual figure underscores the resilience of the sector in the face of significant challenges. While the 2W, 3W, PV, and tractor segments all recorded positive y-o-y growth during the calendar year, the CV segment remained relatively unchanged. The 3W, PV, and tractor segments reached all-time sales highs, while 2Ws narrowly missed surpassing their CY18 peak. The positive performance in these specific segments points towards sector-specific factors contributing to their relative resilience. Improved supply, the introduction of new models, and strong rural demand bolstered the 2W market, while network expansion and new product launches helped the PV segment. However, the latter segment experienced margin pressures due to the necessity of discounting to clear high inventory levels.

Looking ahead to January 2025, the outlook from auto dealers remains cautiously optimistic. Nearly half (48.09%) of dealers surveyed anticipate growth, with 41.22% expecting stable demand. Only a smaller percentage (10.69%) foresee a decline. While this balanced outlook suggests a degree of confidence, it also underscores the prevailing uncertainty within the market. FADA and Mr. Vigneshwar emphasize the importance of continued product availability, strategic marketing initiatives, and supportive government policies to sustain the momentum in the short term. Specifically, Mr. Vigneshwar highlighted the need for PV manufacturers to carefully manage their supply chains to avoid overstocking and subsequent discounting pressures. The overall sentiment suggests that while the immediate outlook remains challenging, a gradual recovery is expected, contingent upon various market and economic factors.