|

|

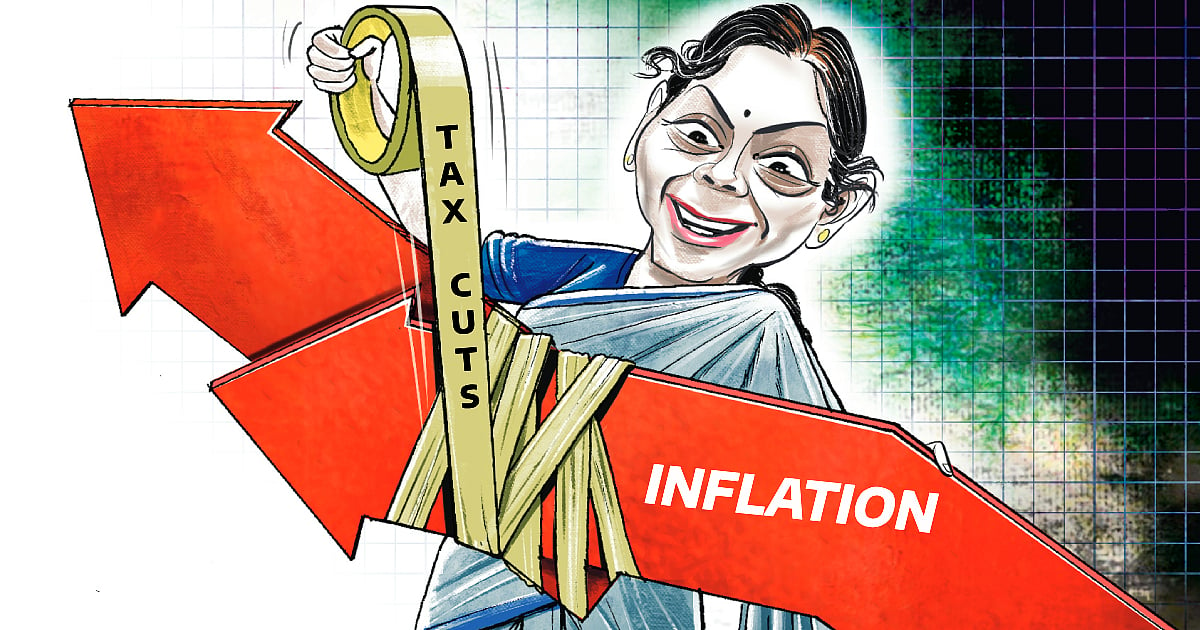

The Indian government is actively considering a significant reduction in income tax for individuals earning up to ₹15 lakhs annually. This potential tax break, slated for implementation in the 2025-26 Union Budget, is a direct response to growing concerns about the economic strain on India's middle class. The move is seen as a crucial step to stimulate consumption and revive economic growth amid a period of slowdown and rising living costs. While the precise details of the tax cuts remain undecided, the government's intent signals a shift in fiscal policy towards providing relief to a substantial segment of the population.

India's current income tax system operates under two distinct regimes: the Old Tax Regime (OTR) and the New Tax Regime (NTR). The OTR, a more established system, allows for various deductions and exemptions based on investments in insurance, provident funds, and housing loans. This regime features tax slabs with increasing percentages for higher income brackets. In contrast, the NTR, introduced in 2020, offers lower tax rates but eliminates exemptions and deductions. This creates a choice for taxpayers depending on their individual financial situations and investment strategies. The proposed tax cuts are likely to impact both regimes, making the NTR potentially more attractive to a larger portion of taxpayers.

The decision to consider income tax cuts is driven by a confluence of factors. The current economic climate is characterized by a noticeable slowdown, coupled with persistently high inflation. This has placed considerable pressure on the middle class, whose wage growth has not kept pace with the rising cost of living. The government has faced increasing criticism for what many perceive as an overly stringent fiscal policy. The recent second-quarter GDP figures further highlighted the economic fatigue, amplifying calls for a shift towards growth-oriented policies, even if it means compromising slightly on fiscal prudence. The Chief Economic Advisor, V. Anantha Nageswaran, has openly criticized the disparity between record corporate profitability and stagnant worker salaries, emphasizing the need for a balance to stimulate consumption.

The argument for tax cuts is not merely driven by social welfare considerations; it's also deeply rooted in economic strategy. Economists and business leaders alike point to the stagnation in consumer spending as a major contributing factor to the economic slowdown. A reduction in the tax burden would directly increase disposable income for a significant portion of the population. This injection of purchasing power is expected to lead to higher consumer spending, thereby boosting demand across various sectors. This ripple effect could stimulate economic activity and contribute significantly to the recovery process. Concerns raised by prominent figures like Nestle India's MD, Suresh Narayanan, underscore the challenges facing the FMCG sector, with volume growth significantly dampened by inflation and a perceived 'shrinking middle class.'

The potential tax cuts represent a delicate balancing act for the government. While the aim is to stimulate the economy and alleviate pressure on the middle class, there are potential implications for fiscal consolidation. Many economists advocate for a more lenient approach to fiscal consolidation at this juncture, arguing that the benefits of boosting consumer confidence and economic activity outweigh the short-term risks. The government’s approach will be closely watched, representing a crucial test of its economic strategy amidst challenging circumstances. The decision will be a major determinant in shaping the economic landscape of India in the coming years, impacting everything from consumer spending to investor confidence.

The proposed income tax cuts aren't simply about numbers on a spreadsheet; they are a response to real-world struggles faced by millions of Indian citizens. The rising cost of essential goods, from food to fuel, has eroded purchasing power, impacting the quality of life for many families. The government's consideration of tax relief reflects a recognition of these struggles and an attempt to address them through targeted economic policy. The outcome of this decision will not only have immediate economic implications but will also have a significant political impact, influencing public perception of the government's responsiveness to the needs of its citizens. The level of tax cuts, the specific implementation details, and the overall impact will be eagerly anticipated as India heads towards the 2025-26 budget cycle.

Source: Centre mulls income tax cut in 2025-26 Budget amid middle-class heat