|

|

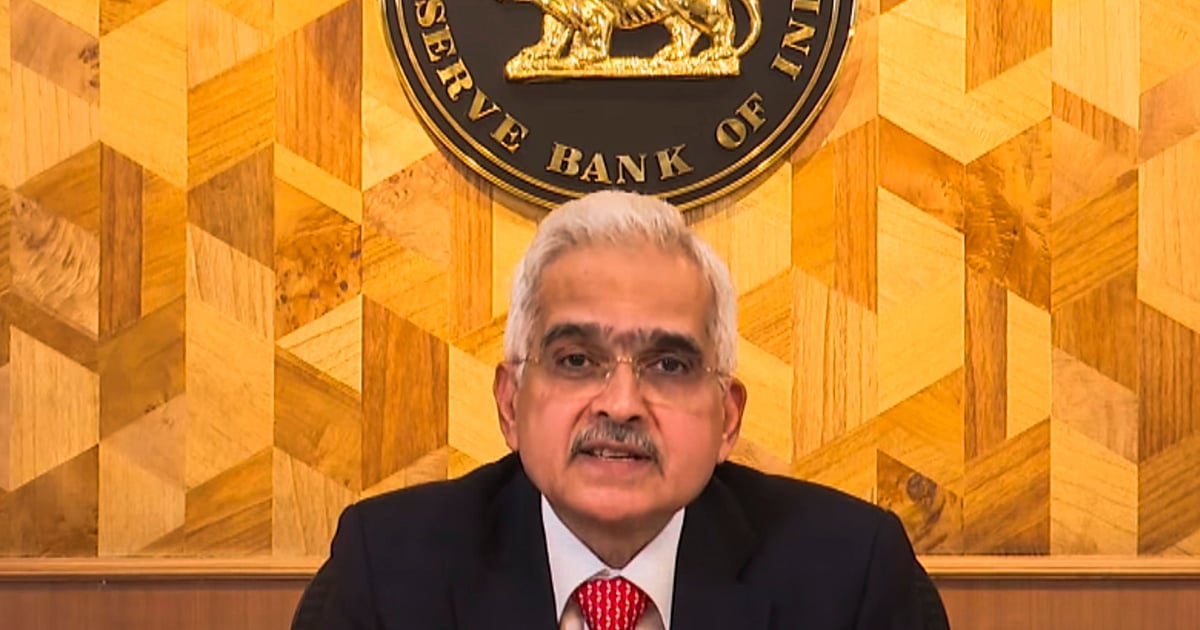

Shaktikanta Das's tenure as the Governor of the Reserve Bank of India (RBI) officially concluded on December 10th, marking the end of his second three-year term. His departure signals a significant shift in the leadership of India's central bank, an institution pivotal in navigating the nation's complex economic landscape. Das, a seasoned bureaucrat with a career spanning decades, assumed the governorship in December 2018, succeeding Urjit Patel who resigned amidst considerable speculation. His appointment, at the time, was viewed as a strategic move by the government, given his extensive experience in managing crucial economic policies and his understanding of the intricacies of India's financial system. Das's legacy is deeply intertwined with some of the most impactful economic events in recent Indian history.

Das's tenure was defined by his stewardship of the Indian economy through turbulent periods. He played a crucial role in implementing and overseeing the Goods and Services Tax (GST), a landmark indirect tax reform that significantly reshaped India's tax structure. The complexities of GST implementation, including its technological aspects and integration across various states, required astute management and a nuanced understanding of both economic theory and practical implementation. Das's expertise in navigating bureaucratic hurdles and aligning various stakeholders proved crucial in the relatively smooth implementation of the GST, though challenges remain to this day. Furthermore, he was at the helm during the aftermath of the 2016 demonetization, a controversial policy decision that shook the nation's financial system and required a sensitive and strategic response from the RBI.

The COVID-19 pandemic presented an unprecedented challenge, forcing the RBI to undertake an extraordinary monetary response. Under Das's leadership, the RBI implemented a series of measures to mitigate the economic fallout of the pandemic, including substantial liquidity injections, interest rate cuts, and regulatory forbearance measures for struggling businesses. The effectiveness and timing of these measures were crucial in preventing a more severe economic contraction and maintaining financial stability. His decisions during this critical period showcased his ability to adapt to unpredictable circumstances and make swift, decisive actions under immense pressure. The pandemic forced the RBI to adopt unconventional monetary policies, requiring a balance between supporting the economy and managing inflationary pressures – a tightrope walk that Das successfully navigated, albeit not without criticism.

Das's successor, Sanjay Malhotra, currently serving as Revenue Secretary in the Union Ministry of Finance, brings his own set of experiences and expertise to the role. Malhotra's background in public finance and tax administration is expected to influence the RBI's approach to economic policy. The transition period will likely involve a careful handover of responsibilities and a review of ongoing policies. While there might be a shift in emphasis and approach under the new leadership, the continuation of policies already in place is also likely, considering the momentum they have gained. The coming months will reveal the specific direction Malhotra intends to take the RBI and the impact his leadership will have on India's economy.

The appointment of a new RBI governor is a significant event with far-reaching consequences for India's economic trajectory. Das's tenure, marked by substantial economic reforms and the navigation of unforeseen crises, will be studied and analyzed for years to come. His legacy will be judged not only on the immediate successes and failures but also on the long-term impact of his decisions on the stability and growth of the Indian economy. The challenges facing the RBI, including inflation management, the integration of fintech, and the growth of the digital economy, remain substantial. The coming years will test the leadership of Sanjay Malhotra and his ability to address these critical issues.

In conclusion, Shaktikanta Das leaves behind a legacy shaped by his handling of significant economic reforms and unprecedented crises. His tenure as RBI governor will be remembered as a period of both significant achievements and considerable challenges. The focus now shifts to Sanjay Malhotra, whose appointment signals a new chapter in the history of the Reserve Bank of India, carrying with it both the expectation of continuity and the potential for significant change. The economic and political dynamics within India will be significant factors in determining the success of his leadership in the years to come. The coming years will serve as a crucial test of the resilience of India's financial system and the efficacy of policies implemented under the leadership of both Shaktikanta Das and his successor, Sanjay Malhotra.

Source: Shaktikanta Das: The man behind GST, note ban and monetary response during Covid