|

|

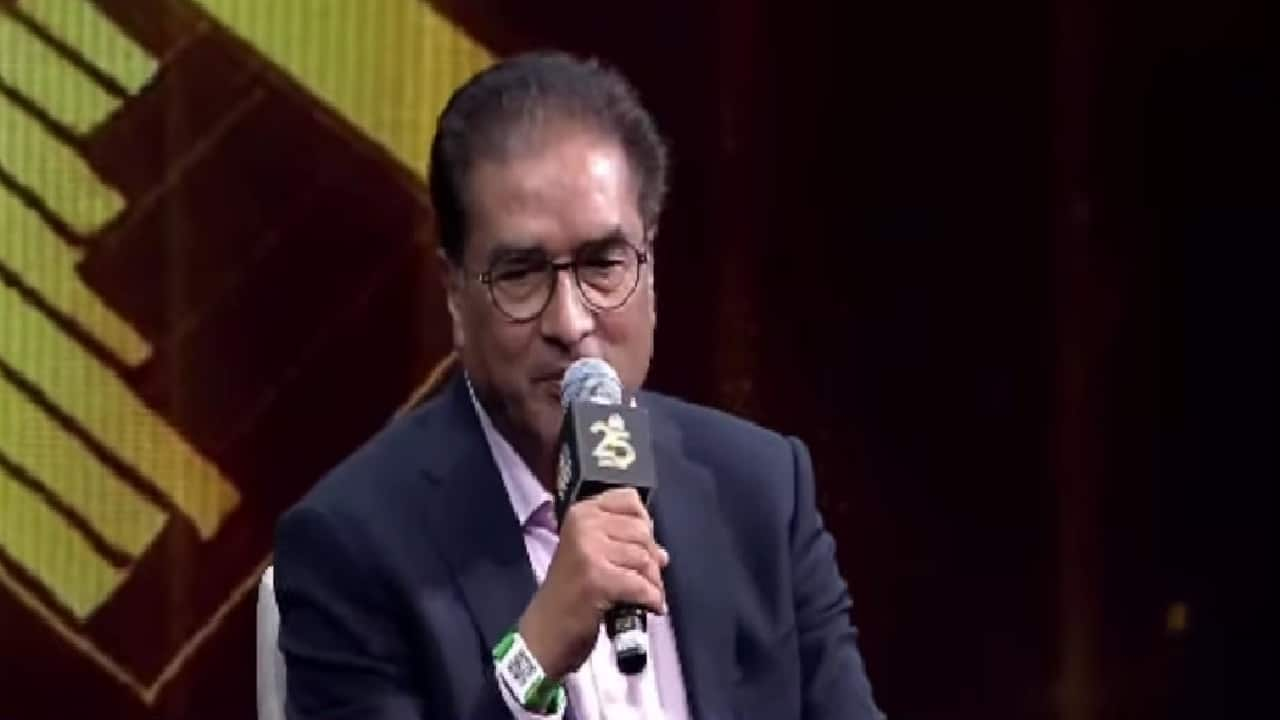

The Indian stock market is anticipating a resurgence of Foreign Institutional Investors (FIIs) and the potential for the Nifty index to reach a milestone of 30,000 points. This optimistic outlook comes from market veteran Raamdeo Agrawal, Chairman and Co-founder of Motilal Oswal Financial Services Ltd. Acknowledging a temporary slowdown in earnings for Indian companies, Agrawal sees this as a phase that will soon pass, paving the way for FIIs to return to Indian markets.

Agrawal highlights that the current pullback of FIIs, stemming from factors like the attractiveness of US markets and the rise of cryptocurrencies, is a temporary trend. He believes that once FIIs return to India, they will not find the same competitive pricing they left behind, potentially pushing the Nifty index towards 30,000. This suggests a belief in the inherent strength of the Indian economy and market, despite current challenges.

Echoing Agrawal's sentiments, other market experts emphasize the importance of long-term investment and patience. Ramesh Damani, Owner of Ramesh Damani Finance Pvt Ltd, advocates for investing in high-quality stocks over extended periods, emphasizing the power of compounding. Ashishkumar Chauhan, Managing Director and Chief Executive Officer of NSE, points to the growth of the Indian market infrastructure as a strong indicator of future potential, particularly in sectors like technology and biotechnology.

The article emphasizes the need for investors to be patient and remain invested in high-quality businesses. This is particularly relevant for new investors who are entering the market for the first time. The power of compounding, which allows for long-term wealth accumulation, is emphasized as a key factor in achieving financial success.

Source: When FIIs come back, Nifty could be 30,000, says market veteran Raamdeo Agrawal