|

|

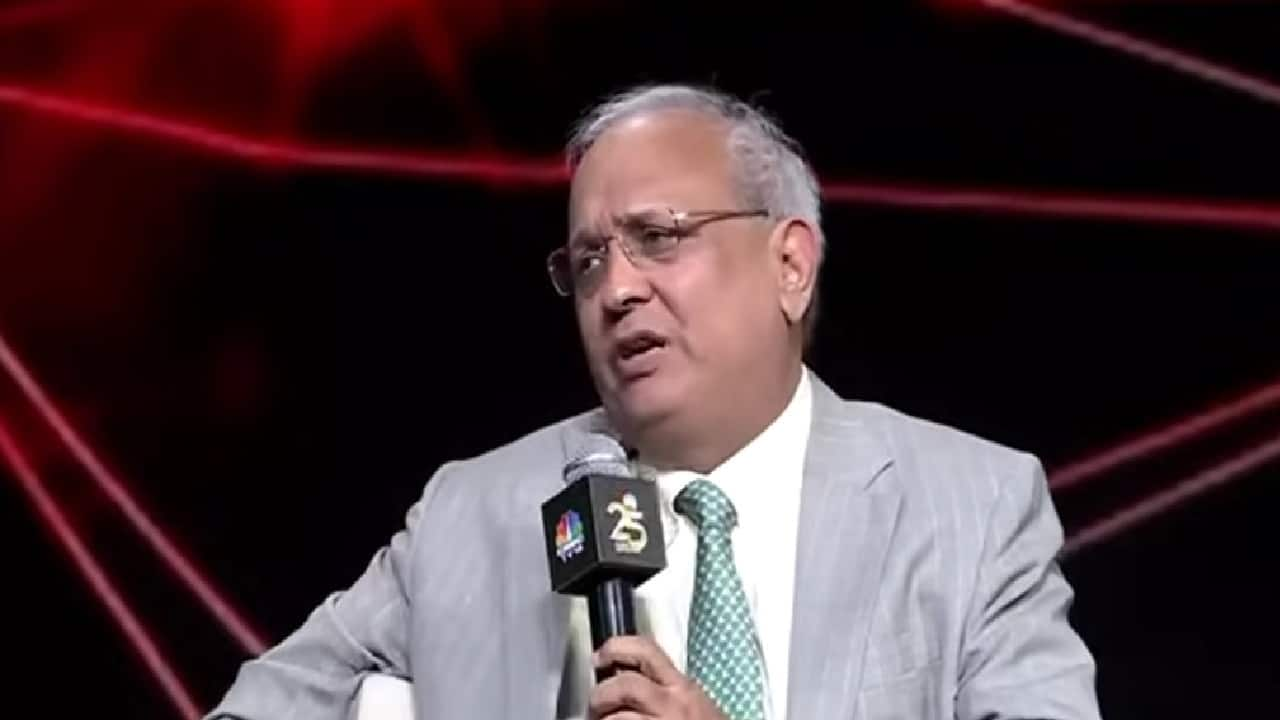

In a recent post on X, Samir Arora, founder of Helios Capital, expressed skepticism regarding the bullish outlook on India presented by CLSA, a prominent global brokerage firm. Arora, a veteran stock market investor, argued that the report shouldn't create 'unnecessary' excitement among investors. He articulated his viewpoint through a series of insightful observations.

Firstly, Arora highlighted the distinction between CLSA and the Central Intelligence Agency (CIA). He implied that investors should not blindly trust the report's optimistic projections, suggesting that CLSA's analysis might not be as authoritative or insightful as a government intelligence agency. This subtle jab underscores the importance of independent analysis and critical thinking before making investment decisions based solely on a single report.

Furthermore, Arora countered the common perception that investors were exiting India to invest in China. He maintained that the real shift in investment preference was from India to the United States. This assertion suggests that the market dynamics surrounding India's performance might be linked to the attractiveness of the US market rather than China's economic prospects. This understanding helps to contextualize the report's focus on India and its potential impact on Indian investors' strategies.

Lastly, Arora emphasized that the India-to-US investment shift might have already peaked. He cited the relative price movements of average Indian and US stocks since September, pointing to a significant price differential that may have already reflected the investment shift. This observation implies that investors who were considering this trade shift might have already missed the opportunity to capitalize on the price disparity. Arora's perspective suggests that the market might be in a state of equilibrium, with the initial momentum of the shift waning.

Arora's cautious stance towards CLSA's report challenges the immediate assumption that India is poised for significant outperformance. His analysis emphasizes the importance of scrutinizing investment recommendations and considering broader market dynamics beyond a single report. By highlighting the potential for overreaction and reminding investors of the possibility that the investment shift might be over, Arora encourages a more balanced and nuanced approach to investment decisions.

Source: CLSA report shouldn't make investors unnecessarily excited, says Samir Arora