|

|

The Indian political landscape has been shaken by allegations of corruption leveled against Madhabi Puri Buch, the Chairperson of the Securities and Exchange Board of India (SEBI). The Congress party has accused Buch of engaging in unethical practices, claiming that she rented out one of her properties to Carol Info Services, a company linked to the pharmaceutical giant Wockhardt, which is currently under investigation by SEBI itself for several alleged financial irregularities. The Congress party alleges that this rental agreement constitutes a clear conflict of interest, given Buch's role as the head of SEBI and the ongoing investigations against Wockhardt.

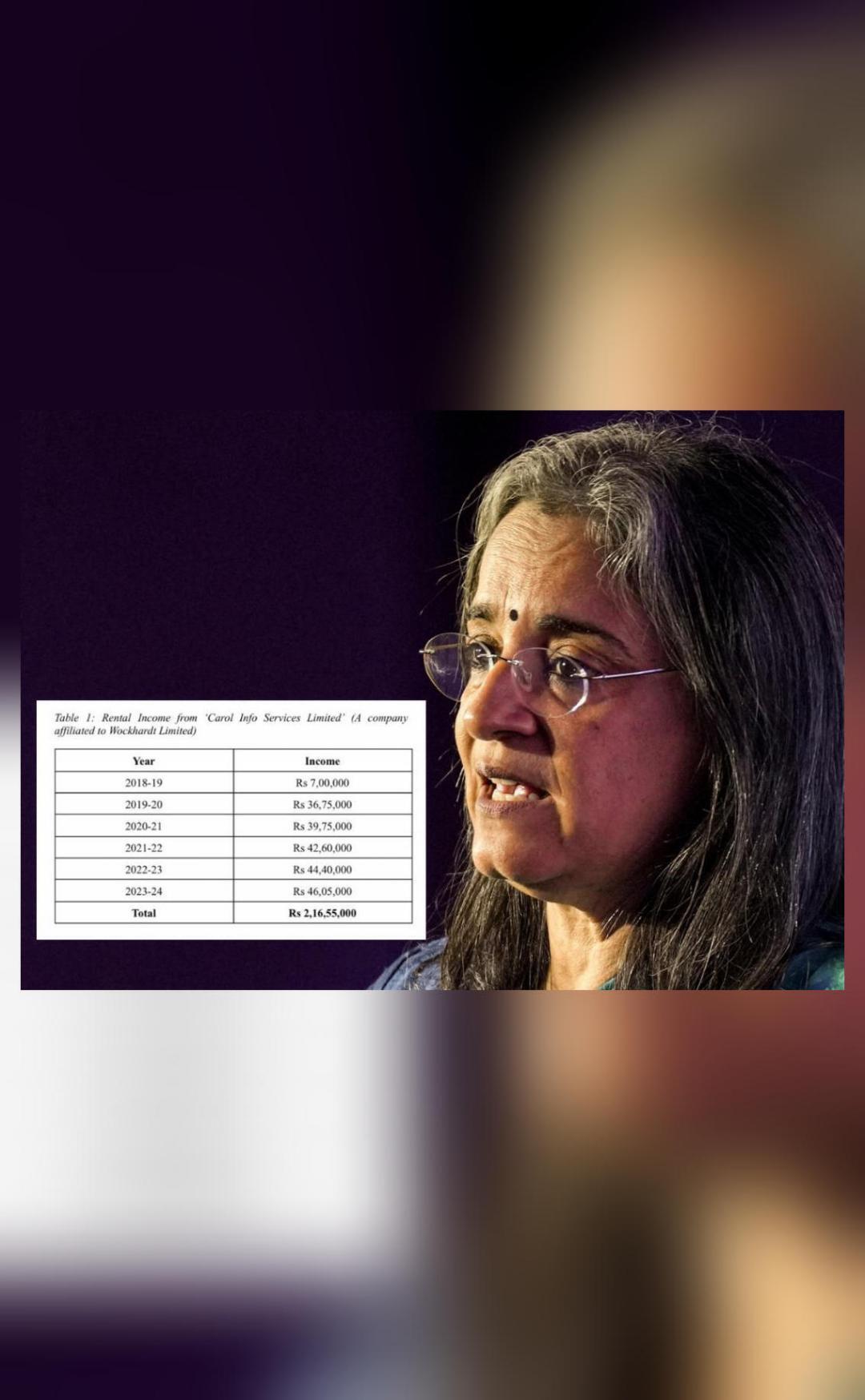

The allegations further state that Buch received a significant sum of ₹2.16 crore in rental income from Carol Info Services between the years 2018-19 and 2023-24. This period coincides with Buch's tenure as a whole-time member of SEBI. This revelation has sparked outrage and raised serious concerns about the potential for impropriety within the regulatory body. The Congress party, in its statement, has called for a thorough and impartial investigation into these allegations, asserting that such actions undermine the integrity and credibility of SEBI, the regulatory body tasked with ensuring transparency and fairness in the Indian financial markets.

This accusation against Buch has ignited a debate on the ethical standards and accountability expected of individuals holding high-ranking positions within regulatory bodies. The Congress party's accusations, if proven true, could have significant repercussions for Buch's position as SEBI Chairperson and could damage public trust in the regulatory body. The Indian public is keenly watching the unfolding events, eager to see if an impartial investigation will be conducted and whether justice will be served. The outcome of this case could have far-reaching consequences for the Indian financial system and the public's perception of regulatory oversight.