|

|

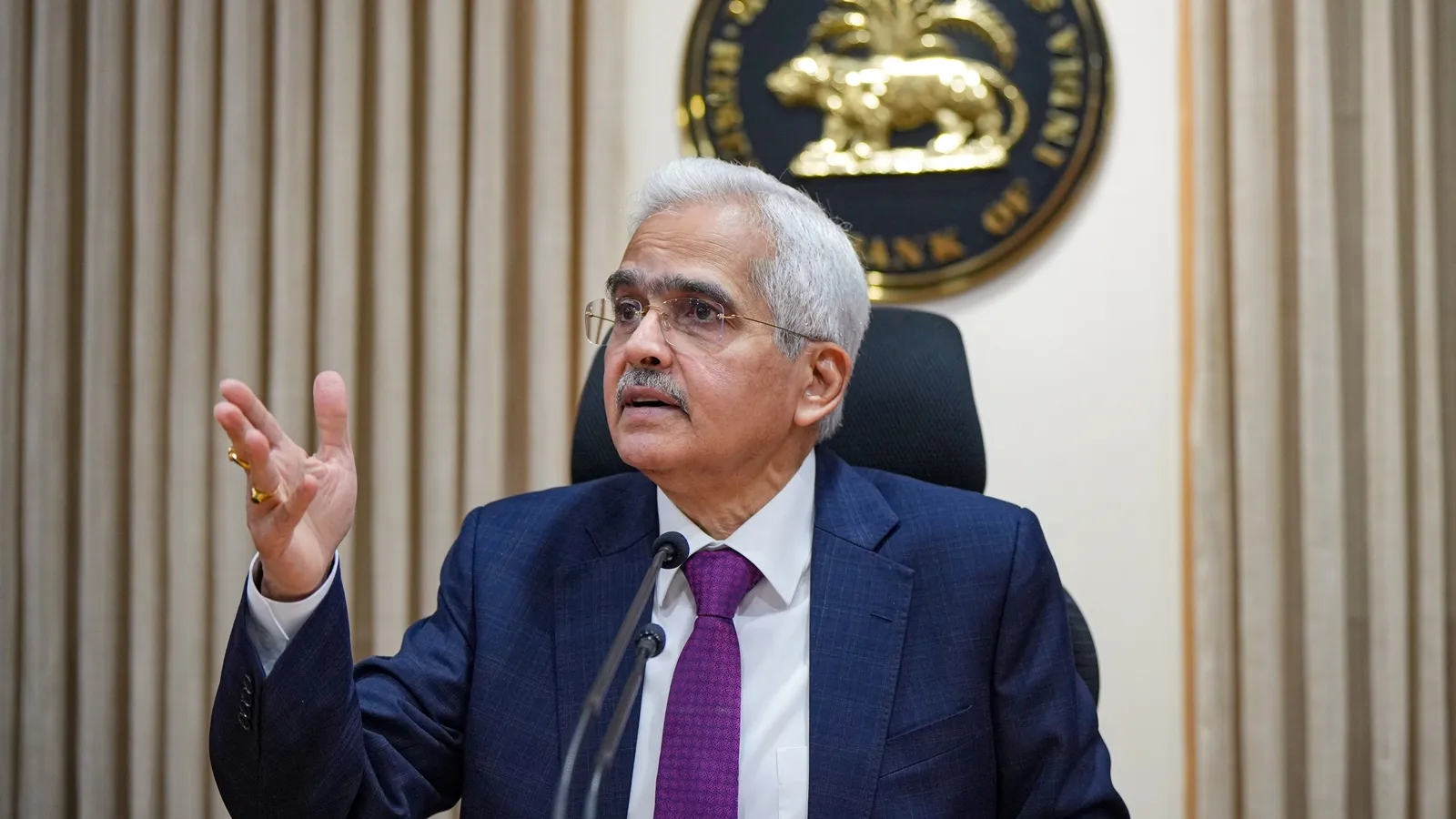

The Reserve Bank of India (RBI) Governor, Shaktikanta Das, has outlined a clear vision for the future of India's digital payment systems, aiming to make the Unified Payments Interface (UPI) and RuPay card payments network truly global. This ambitious goal involves expanding their reach and functionality beyond India's borders, connecting them with other countries' payment systems and creating a more interconnected financial landscape. The RBI is actively working to deploy UPI-like infrastructure in foreign jurisdictions, facilitate QR code-based payments at international merchants, and link UPI with Fast Payment Systems (FPS) in other countries to streamline cross-border remittances. This is not just a strategic move to boost India's economic influence but also a tangible way to empower Indian businesses and citizens with greater financial freedom and convenience.

Progress in this direction has already been made, with notable examples like the integration of UPI with Singapore's PayNow system, enabling faster and more affordable remittances between the two countries. The UPI QR code is also being accepted in Bhutan, France, Mauritius, Sri Lanka, Nepal, and the UAE, enhancing the reach of India's digital payments infrastructure. RuPay card acceptance is also expanding, with Nepal, Bhutan, Singapore, Mauritius, and the UAE now accepting Indian RuPay cards, and vice versa. These developments, including the agreements with regulators in the UAE, Nepal, Namibia, and Peru to implement UPI-like solutions, signify a growing global acceptance and integration of India's financial initiatives.

Beyond UPI and RuPay, the RBI's focus on international cooperation extends to India's own Central Bank Digital Currency (CBDC), currently in its pilot stage. The programmability features of CBDC are being explored to facilitate innovative financial services, such as providing credit to landless farmers and supporting carbon credit initiatives for farmers. This demonstrates the potential of CBDC to be a powerful tool for social and environmental initiatives, opening up new avenues for collaboration and financial inclusion across borders. While India has made significant strides in developing its digital financial infrastructure and building international partnerships, the journey towards truly globalizing UPI, RuPay, and CBDC is ongoing. However, the RBI's proactive efforts and commitment to collaborative initiatives hold promising potential for a more interconnected and inclusive global financial system.

Source: Focusing on making UPI, RuPay truly global: Shaktikanta Das