|

|

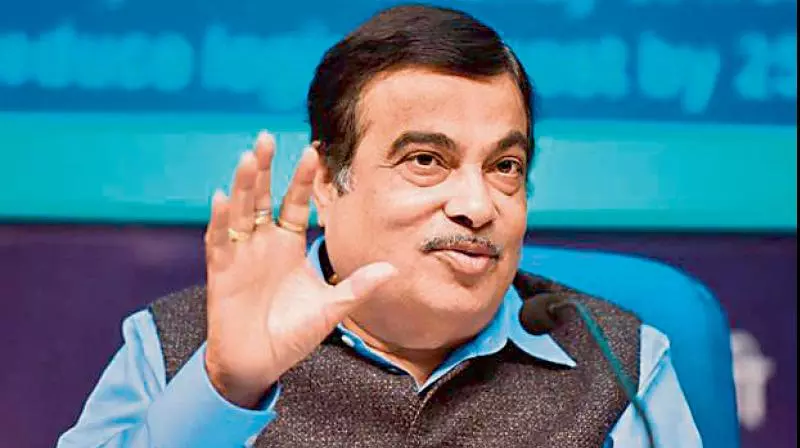

The article highlights a pressing issue in the Indian financial landscape: the 18% Goods and Services Tax (GST) levied on life and medical insurance premiums. Union Minister Nitin Gadkari, in a letter to Finance Minister Nirmala Sitharaman, has advocated for the removal of this tax, echoing concerns raised by the Nagpur Division Life Insurance Corporation Employees Union. Gadkari argues that imposing GST on insurance premiums amounts to taxing the very uncertainties of life, which directly impacts the affordability of these essential financial safeguards. The minister emphasizes that the individual seeking protection for their family should not be further burdened with taxation on the premium they pay for this security.

Gadkari's letter also underscores the detrimental effect of the current GST policy on the insurance sector's growth. He contends that the 18% tax serves as a deterrent, particularly for the medical insurance segment, which is crucial for the well-being of the population. The minister further highlights the incongruity of taxing insurance premiums while simultaneously encouraging savings through life insurance policies. He suggests a review of the tax deductions available for health insurance premiums and calls for a unified approach towards public sector general insurance companies.

The article concludes by noting that the GST Council, the body responsible for tax-related decisions in India, is scheduled to convene in August. This meeting is anticipated to address the issue of GST on life and medical insurance premiums, potentially leading to a reevaluation of the current policy. Gadkari's plea, coupled with the concerns raised by the insurance industry, underscores the need for a comprehensive and fair approach towards taxation in the realm of insurance, ensuring that individuals have access to affordable and accessible protection against life's uncertainties.

Source: Gadkari Urges Removal of 18% GST on Life, Medical Insurance